Acquire with the intention to retain, and retain with the intention to grow

-- Lester Wunderman

In an economic downturn, capital is not easy to come by. Investors are faced with hard decisions and tend to take a closer look at where they're investing. This is when the rose-hued tint begins to come off the glasses in investor meetings and hard, pointed questions are asked of entrepreneurs and business owners. Inexorably, the basics begin to take precedence over abstract promises—barebones metrics and KPIs that reveal the state of your business health become central to acquiring capital and for valuation.

Net Revenue Retention is one such central, decisive metric . Unlike Recurring Revenue, it is a retrospective metric that tells you about the state of your revenue, customer retention, and customer engagement. This is precisely why, in an economic downturn, it is prioritized by anyone who is looking to take a stake in your business—it is a quick look into your ability to build for GTM efficiency. When funds and returns on investment are scarce, evaluating businesses through NRR is a back-to-the-basics no-frills approach many companies are gravitating towards.

First things first. What is NRR?

Simply put, it is the percentage of revenue retained by a business from existing customers over a month or a year (or any specified period of time). To calculate it, you take your monthly/annual recurring revenue (Starting MRR), add any revenue made from upselling and cross-selling (Expansion MRR), subtract revenue from contractions (Contraction MRR) as well as that from lost customers (Churn MRR) and then the result as a percentage of the monthly/annual recurring revenue.

NRR = (MRR + Expansion MRR − Contraction MRR − Churn MRR x 100) ÷ MRR

Let's say your monthly Revenue is $ 100,000. Let's also suppose that the amount of additional revenue you've made from expansions—upgrades, additional features, add-ons sold—is $ 25,000. In addition to this, you have customers who downgrade their subscriptions or remove some of the features you have offered them. Let's say this Contraction MRR amounts to $5000.

If you have lost two customers who were contributing $5000 each monthly to churn, then using the formula,

NRR = ($100,000 + $25,000 − $5,000 − 2 $5,000 x 100) ÷ $100,000 = 110%

For small-to-medium businesses, an NRR of 90% is considered a baseline of business health, while for big corporations, the number should ideally be above 120%.

Why do Investors and C-Suite care about NRR over other metrics?

Investors and C-Suite executives look at NRR as a business health check. Since NRR is a retrospective metric as opposed to a projection, and since it contains information about customer retention as well as the depth of a customer’s investment in your service or product, investors use it as a key metric to determine your startup or company’s valuation. It goes without saying that what this metric reveals about your company’s stability and potential makes it equally critical a metric for acquisitions, IPOs, and other ventures—more so during an economic downturn.

How to Increase NRR

To increase your Net Retention Rate, you need to ensure that (i) your account is expanding and that (ii) your churn is low. To control these factors, it is imperative to figure out how to manage expansion and churn —after all, it is only when you really understand what factors influence a performance metric that you gain the insight and the means to control it.

Growing Upsell-Upgrade-Expand Revenue

The most reliable way to grow NRR is to increase the share of customer wallet from existing customers. The onus is on RevOps/Customer Success teams to identify existing customers who will benefit from the following:

- Adding on more units of the product currently licensed

- Upgrading to a higher tier (and therefore higher-priced) product

- Expanding their footprint by signing onto additional products from the company

Your RevOps and Customer Success teams need to identify which products will benefit which business units within customers, and build a cross-functional account engagement plan to ensure that a percentage of your customers are always upgrading and driving your NRR growth.

Towards that goal, you must have a robust and agile way to study account cohorts. What you’re looking for is actionable insight into what products are getting traction with which customer segments and what factors drive that conversion. A newly emerging space called Revenue Observability can help you gain that visibility, without dependence on resource-strapped analyst resources, enabling you to maximize customer lifetime value by targeting the right customers on the right set of products and features. For example, you can quickly identify which mix of customer organization size, industry and region is particularly suited to expansion sales; or which products are able to generate higher-velocity expansion sales, as shown in the graphs below.

Expansion revenue breakdown by industry and Expansion sales cycle by add-on product

Source: BigLittle Revenup

Reducing Churn

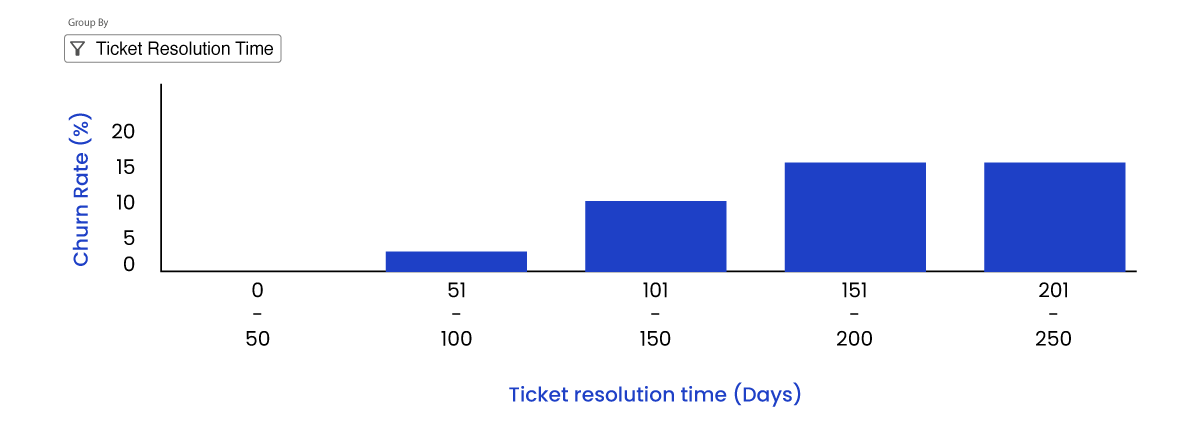

The first order of business to reduce churn is to identify those customers that are likely to churn. Upstream churn signals can include lack of engagement with the product, customer community or the customer success or sales organization. Other churn signals are dissatisfaction with product quality or vendor issue resolution— as documented in support tickets, email interactions or social media.

Once you identify those customers susceptible to churn, you can drive up your NRR by formulating specialized loyalty programs for this target group and providing a pathway to upgrade their subscription. Maintaining open lines of communication with the customer and demonstrating commitment to resolving existing support issues is of course crucial. At the same time, understanding the overall buyer’s journey for each individual in the account can provide clues to why existing customers go elsewhere to resolve their organizational pain point. Revenue observability tools like BigLittle’s Revenup can track this and provide insights that can reduce potential churn in the future.

Ideal Customer Profile

A strategic way to improve NRR is to make sure you are focusing on the right customers with the best long-term revenue potential. Often, companies will define an ideal customer profile (ICP), but as they begin executing their plans, they end up deviating from the plan, and the impact of these deviations on revenue is often unquantified. A deep-dive analysis of GTM performance may uncover that their ICP is actually composed of multiple segments or cohorts, each of which responds differently to the company’s products and services. In this case, the ICP itself may need to be fine-tuned for maximizing revenue and NRR. In other situations, the company may find itself executing its plans out of alignment with the originally defined strategy. Focusing on an ICP early on in the process, using analytical tools (such as revenue observability) to understand how different GTM actions are performing against your ICP, and making necessary adjustments to your strategy and execution along the way are great ways to strategically drive revenue repeatability, and increase NRR.

BigLittle Can Help You Transform Your NRR Performance

At BigLittle, we are helping define and build this future of RevOps. Our product Revenup is a Revenue Observability and Intelligence solution for GTM teams looking to drive predictable revenue. We track and triage all revenue processes end-to-end across marketing, sales, and customer success operations. By working with and at a level above the operational GTM tools, we discover early indicators of NRR shortfall in real-time and auto-identify root cause and remedial action without the need for expensive and time-strapped analyst resources.

Get in touch with us to know more.

Get in Touch